Managing finances effectively is one of the biggest challenges faced by couples. Understanding how to manage money as a couple can help avoid conflict and stress.

Here are some tips to better understand finances for couples.

Open and honest communication is the basis for any healthy relationship, especially when it comes to finances.

Both partners must be aware of the joint financial objectives and the plan to achieve them.

Determine what is a "need" and what is a "want". This will help you avoid unnecessary spending.

Also, set up a regular savings plan to ensure that you are prepared for emergencies or major expenses in the future.

Couples should work together to establish a budget. This helps ensure that both of you are on the same page about where the money is going and how much is being saved.

First of all, managing finances as a couple doesn't have to be a struggle.

With open communication, careful planning and collaboration, you can navigate financial challenges together.

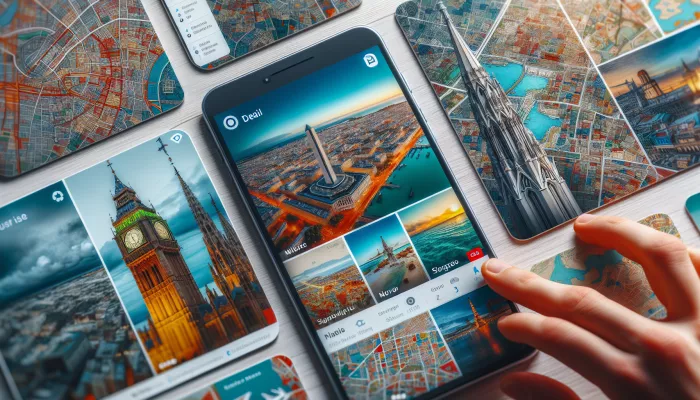

There are various online tools and apps that can help couples organize their finances.

A financial management is often seen as a purely practical and technical aspect of a relationship.

However, it has a lot to do with interpersonal dynamics, communication and overall satisfaction in a relationship. Here are some reasons why financial management is so important.

Financial problems can lead to misunderstandings and tensions in a relationship, especially if they are not addressed openly.

Good financial management implies a frank exchange of ideas between the partners, which always leads to more effective communication.

Only with a truly open discussion about your finances can you begin to make the decisions that will benefit the relationship in the long term.

By maintaining sound financial management, you will cultivate a greater feeling of security within the relationship.

Knowing that finances are under control, both partners can focus more on the quality of the relationship and less on everyday worries.

With proper financial management, couples have the opportunity to discuss common financial targets.

Whether these goals are big or small, like buying a house or saving for a trip, pursuing a common goal can bring real benefits to the relationship.

Managing finances in a relationship can be complicated, but it's a crucial aspect of achieving a harmonious life together.

Here are some practical tips to help couples deal with their finances efficiently.

The first step to managing finances as a couple is a open communication.

Discuss your financial goals, including savings, investments and spending.

In addition, it is important that both of you are aware of each other's financial situation to avoid future misunderstandings.

Above all, defining a budget is the next step. Agree on a budget that takes into account both income and expenses.

Remember to include personal expenses, household expenses and savings. This budget should be reviewed regularly to reflect any changes in the couple's financial situation.

However, having a joint account can be beneficial in many ways. It can be used for joint expenses such as rent, utility bills and grocery shopping.

However, it is also important that each person in the couple has their own separate account for personal expenses.

Emergencies happen, which is why it's crucial to have an emergency fund. These savings will provide a safety cushion in times of sudden economic crises.

These days, in addition to the daily budget and savings, it's important to plan and invest for the future.

Consider retirement - either through pension plans or investments in assets that are likely to appreciate over time, such as real estate or shares.

Dealing with finances together can seem like a challenging task. However, with open communication, good planning and management, you can create a stable and secure financial environment.

For more help, here are some useful apps and websites: